Bitcoin Lightning Network Exceeds $1B in Monthly Volume – A Major Layer-2 Win

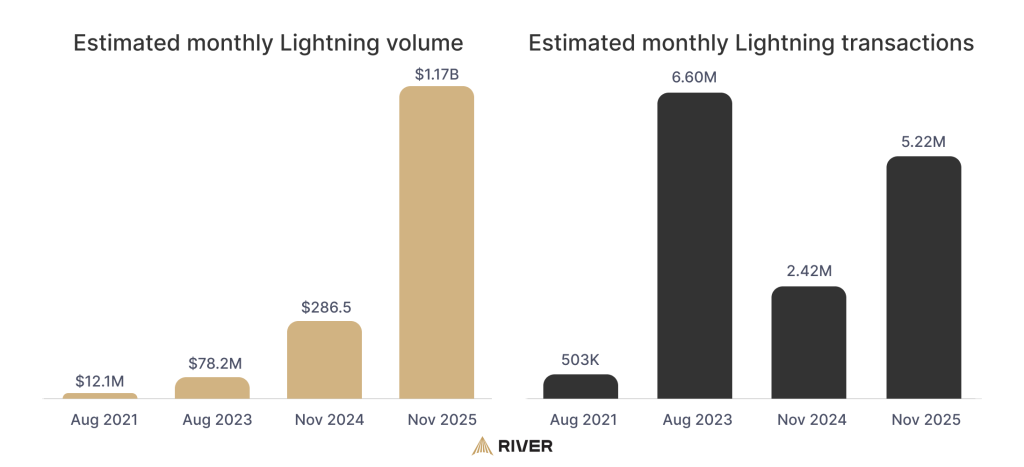

In an article on X, River Financial’s director of marketing, Sam Wouters, revealed that the Bitcoin Lightning Network processed an estimated $1.17 billion in volume in November 2025, an all-time high.

This massive surge signals a critical shift in network usage from experimental micropayments to substantial institutional settlements.

Key Takeaways

- The Milestone: Monthly volume hit an estimated $1.1 billion across 5.2 million transactions according to River Financial data.

- The Shift: Average transaction size nearly doubled year-over-year to $223, driven by exchange settlements rather than small retail purchases.

- The Catalyst: Secure Digital Markets executed a singular $1 million transfer to Kraken in under a second, proving high-value efficacy.

Why The Migration to Bitcoin’s Lightning Network?

Bitcoin is growing out of its “digital gold” narrative. As on-chain fees fluctuate effectively pricing out smaller transfers, the Lightning Network provides the necessary throughput for scalable commerce.

This utility is critical as macroeconomic headwinds and potential rate hikes force traders to seek capital efficiency.

The network is no longer just a playground for developers testing one-satoshi payments. It is becoming financial infrastructure.

While total transaction counts are actually down from the 2023 peak of 6.6 million, the economic value settled has exploded. The market is maturing, prioritizing high-value speed over low-value volume.

Discover: Here’s the next crypto to explode

Breaking Down the Numbers

River Financial’s latest analysis paints a bullish picture of Layer-2 adoption. The estimated $1.17 billion in November volume represents a roughly 400% increase year-over-year. Data indicates the network is successfully capturing commercial flow.

Secure Digital Markets highlighted this capacity by engaging a sending $1 million to crypto exchange Kraken via the lightning network earlier this year. The settlement was instant.

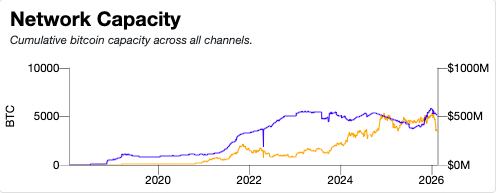

Network capacity, the total coins locked to facilitate these payments, reached a record 5,606 BTC in December 2025, according to data by Bitcoin Visuals.

This liquidity depth is essential for preventing payment failures on larger transfers. Node operators like ACINQ and specialized infrastructure providers are stabilizing the grid, making five-figure transfers reliable.

What Does This Mean for Bitcoin Adoption?

The narrative is shifting from speculation to settlement. Sam Wouters forecasts the next major volume surge will come from AI agents utilizing Lightning for automated, high-frequency machine payments, opening an entirely new economy of autonomous financial actors.

We are seeing a broader trend of financializing Bitcoin’s utility layers. Just as Ledn is scaling Bitcoin-backed bonds for yield, Lightning is scaling Bitcoin for velocity.

The payments landscape is rapidly integrating these Layer-2 solutions, evidenced by Ether.fi moving consumer card products to Layer-2 networks to bypass mainnet congestion.

Discover: The best new crypto on the market

The post Bitcoin Lightning Network Exceeds $1B in Monthly Volume – A Major Layer-2 Win appeared first on Cryptonews.